Services

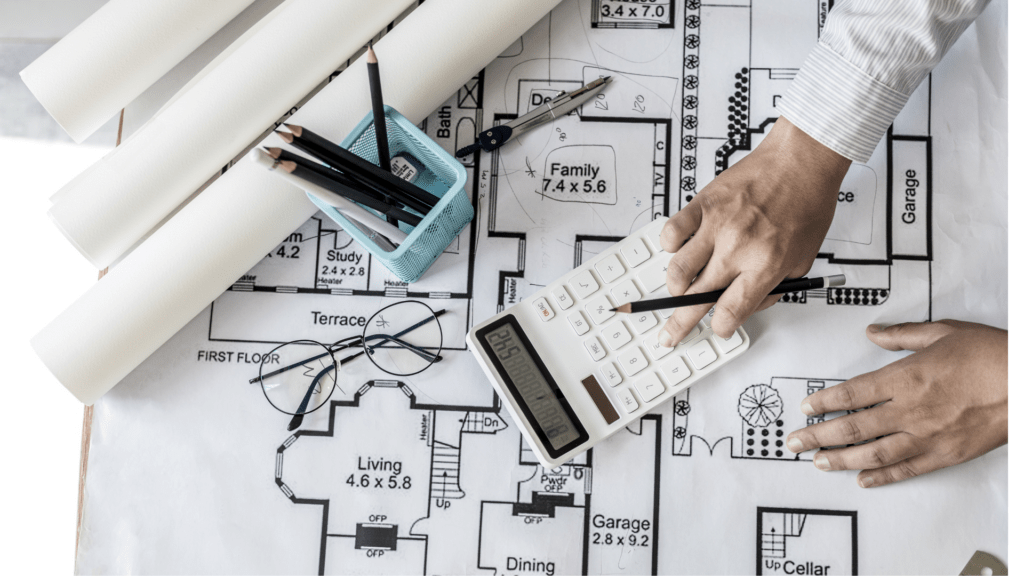

Detailed §45L Tax studies by the experts to maximize depreciation.

"*" indicates required fields

The Section 45L tax credit offers developers a means to offset the costs associated with building energy-efficient single family or multifamily properties. The credit provides a dollar-for-dollar offset against taxes owed or paid in the tax year in which the property is sold or leased.

With the passing of the Inflation Reduction Act, Section 45L has been extended for 10 years through 12/31/2032.

Units leased or sold prior to 2023 are compared to the IECC 2006 standards.

Units leased or sold starting from 2023 will have to be Energy Star certified to avail the §45L tax credit.

To qualify for the coveted 45L tax credit in a post-2022 landscape, businesses and homeowners must now prioritize energy consulting during the design phase of their projects.

This shift underscores the growing importance of sustainable construction and renovation practices, as energy-efficient designs not only reduce environmental impact but also lead to substantial cost savings in the long run. By incorporating energy efficiency consulting early in the process, individuals and businesses can maximize their eligibility for tax incentives while contributing to a greener, more sustainable future.

The 45L tax credit provides a financial incentive for developers, builders, and homeowners to construct or renovate energy-efficient homes. Eligible properties can be single-family homes, townhouses, condominiums, or apartment buildings with no more than three stories above grade. To qualify for the credit, the dwelling units must meet certain energy efficiency standards, which are usually determined by comparing the energy consumption of the property to that of a reference property built according to the standards set by the International Energy Conservation Code (IECC).

The credit amount is up to $2,000 per eligible dwelling unit for new energy-efficient homes and up to $1,000 per eligible unit for qualified energy-efficient improvements in existing properties. The credit is available to the property owner or developer who constructed or renovated the property, not to the eventual homebuyer.

Single-family Homebuilders or multifamily developers can benefit from the Section 45L Tax Credit.

The following energy-efficient buildings leased or sold through qualify for the Section 45L tax credit:

ENERGY STAR certified homes are energy efficient, provide better comfort, and help in reducing carbon emissions and utility costs. ENERGY STAR certification is also a requirement for various financing options, incentives and rebates.

With quality construction from the ground up, you’ll enjoy peace of mind knowing your highly efficient home is built to a high standard of construction for enhanced durability – and a lifetime of memories. Combine that with being a good investment, and ENERGY STAR homes are an excellent choice for your comfort and your bottom line.

ENERGY STAR certified new homes are energy efficient by design, with savings that start now and continue into the future. Better systems and construction features make all the difference throughout your home. ENERGY STAR certified homes are at least 10 percent more energy efficient than standard new homes built to code—and even more efficient when compared to existing homes.

(Meets prevailing wage requirement)

(No limit on stories)

(5 stories or less)

(Does not meet prevailing wage requirement)

(No limit on stories)

(5 stories or less)

The certification process provides flexibility to select a custom combination of measures for each home that is equivalent in performance to the minimum requirements of the ENERGY STAR Reference Design Home, as assessed through energy modeling.

An EPA-recognized Home Certification Organization (HCO)’s Approved Software Rating Tool shall automatically determine the ENERGY STAR ERI Target, which is the highest ERI value that each rated home may achieve to earn the ENERGY STAR.

The preferred set of efficiency measures for the home to be certified are modeled to verify that the resulting ERI meets or exceeds the ENERGY STAR ERI Target.

The Rater must review all items on the National Rater checklists.

Learn More

The preferred set of efficiency measures for the home to be certified are modeled to verify that the resulting ERI meets or exceeds the ENERGY STAR ERI Target.

Read More →

The preferred set of efficiency measures for the home to be certified are modeled to verify that the resulting ERI meets or exceeds the ENERGY STAR ERI Target.

Read More →

The preferred set of efficiency measures for the home to be certified are modeled to verify that the resulting ERI meets or exceeds the ENERGY STAR ERI Target.

Read More →

45L Energy Efficient Home Credit rewards builders and homeowners for constructing or substantially renovating energy-efficient homes.

The tax credit could be in the range of $500 – $5000 per unit for dwelling units placed in service starting from 2023.

Builders and developers who construct or renovate residential properties.