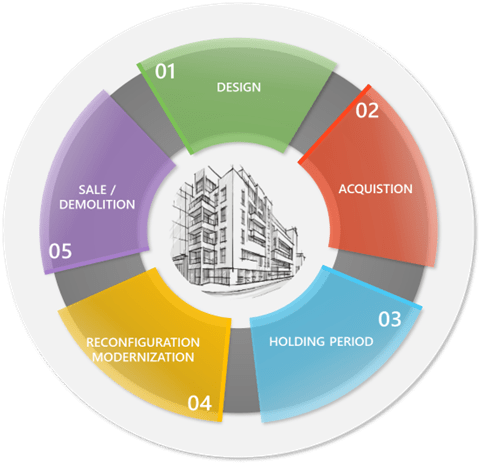

It’s not a “one size fits all” approach. We make it a point of understanding our clients’ needs – not just in the current year but throughout the ownership period. Properties go through life cycles – whether it’s based on use, age, or market conditions. Also, different groups within a client organization play distinct roles within the various phases of the life cycle. It is not uncommon for these groups to be unaware of the value of tax-centric information.

Here are just a few examples of how we can assist and ultimately, how the information from our reports can be utilized.

In the pre-development scenario, accurate cash-flow projections and pro-forma assumptions are critical to the successful outcomes for these projects. While depreciation is often included in the developer’s pro-forma process, accelerated depreciation is not typically a part of the front-end decision to move ahead or not move ahead with a development. Estimating the impacts of accelerated depreciation is an inexpensive and effective way to understand how cash flow, ROI and provision for income tax could be enhanced and become more attractive when the impact of cost segregation is included. We have been routinely included as part of the design and construction teams for major projects. Our involvement has enabled the taxpayer to maximize depreciation deductions by working closely with the design teams to take into consideration material selections, construction methods and proper documentation of special-purpose mechanical and electrical systems. We have assisted many national clients with simple design recommendations that have resulted in converting 39-year assets to 5 -year assets.

It is usually best to have a Cost Segregation study completed following acquisition in order to maximize depreciation deductions from the first day of ownership. Close consideration should be given to the operational strategies for the property to ensure proper scoping of the TPR study to address needs beyond accelerated depreciation, and to gain a better understanding of which assets were specifically included or excluded as part of the acquisition.

Improvements to existing structures might include various Qualified Improvement Property designations which have various rates of recovery – many of which have been and continue to be subject to bonus depreciation.

The holding period of a property represents a significant opportunity to evaluate virtually every capitalized expenditure for potential expense treatment, accelerated depreciation or asset disposition. Activities such as tenant improvements represent major opportunities to harvest missed benefits. Also, in light of the Tangible Property Regulations, a comprehensive study can also properly document all assets that might be subject to disposition in the future. For newly constructed projects, the benefits can be substantial, given that many incentives may apply depending on the timing and type of construction. Bonus depreciation will be with us through 2026.These benefits can be applied to new structures and new improvements. For properties already placed in service, the look back opportunity presents a way to bring forward benefits that were not identified at acquisition or at the time the project was constructed (the same as for newly constructed projects), providing greatly increased cash flow over normal depreciation.

As a property ages, or if market conditions change, many property owners are faced with challenges ranging from small renovations all the way up to re-configuration or redevelopment. The tax implications associated with partial demolition of buildings as well as retirement of existing assets can be significant. We have worked with hundreds of clients who wanted to maximize the tax benefits associated with this phase. Our approach and solutions have been highly customized based on each circumstance.

In the case of a sale, we have assisted many clients and their real estate brokers with projections of depreciation deductions as part of the offering documents. When a property is totally demolished, the tax basis must unfortunately to the basis in land. However, the taxpayer has the ability to write off the remaining basis of 5. 7 and 15-year assets. As such, we have assisted many clients who have chosen to manage a property in place for a short holding period with the ultimate goal of redevelopment – which of course starts the Life Cycle of Real Estate all over again.