Solutions

Section 174 Amortization

On January 31, 2024, the Tax Relief for American Families and Workers Act was passed by a wide margin in the House of Representatives. This was a substantial procedural hurdle for fixing 174 expensing rules. The bill will now head to the Senate for further deliberations. With such an overwhelming bipartisan majority, swift passage is anticipated.

Section 174 of the U.S. Tax Code defines the treatment of Research & Experimental (R&E) expenditures. This section was made a part of the Internal Revenue Code (IRC) in 1954 and allowed for the deduction or amortization of direct and indirect R&E expenditures including:

Taxpayers with R&E expenditures and or software development costs will no longer be able to deduct those costs in the year incurred but will be required to amortize them over no less than 5 years. Section 174 was amended by the Tax Cuts and Jobs Act (TCJA) to require amortization of R&E expenditures paid or incurred for tax years beginning after December 31, 2021. For those tax years beginning after December 31, 2021, tax payers will be required to amortize specific R&E expenditures over a period of five years for costs attributable to domestic research, or a period of 15 years for costs attributable to foreign research. Also, all software development costs are now automatically treated as R&E expenditures and must be amortized in accordance with the recent changes.

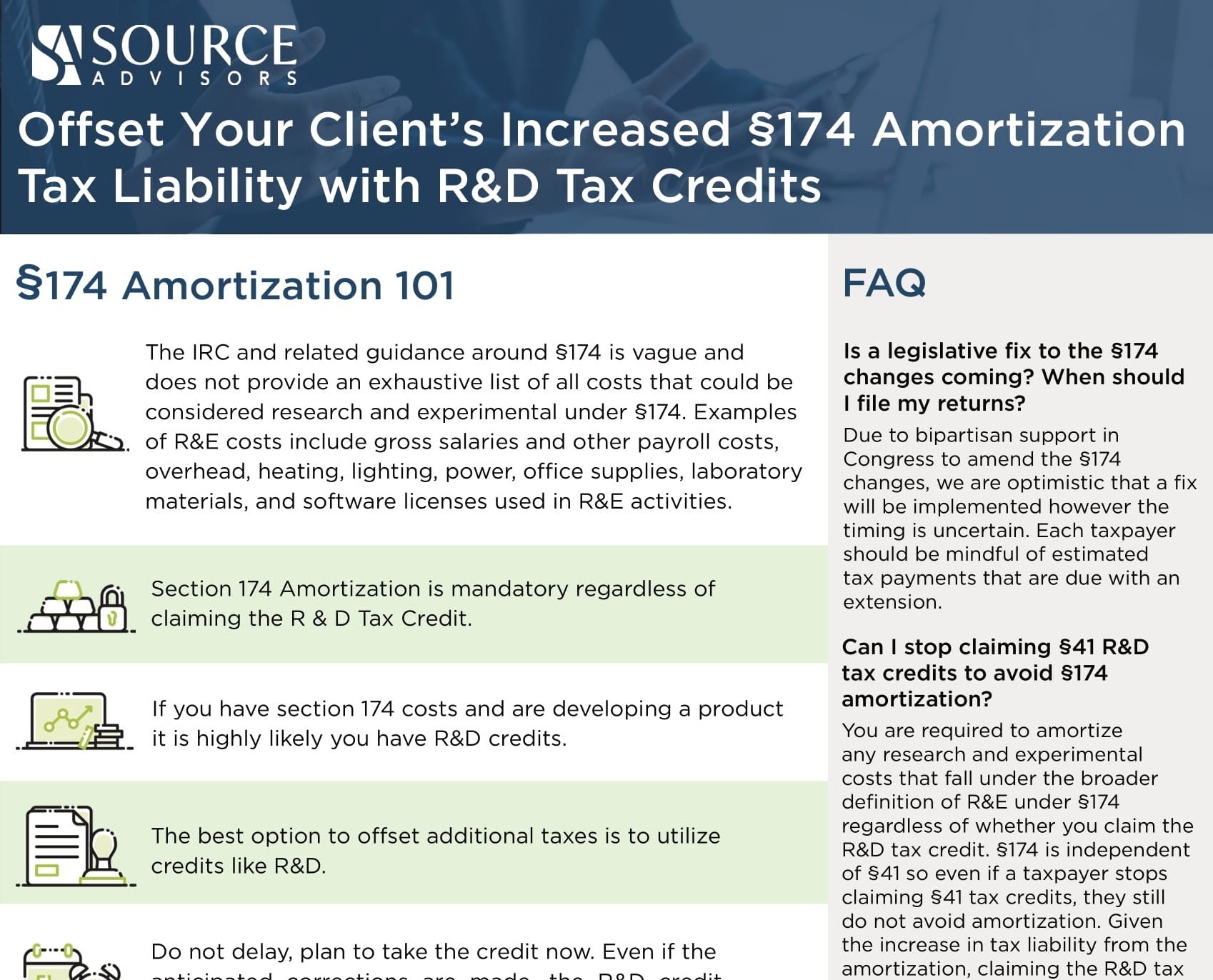

The IRC and related guidance around Section 174 is vague and does not provide an exhaustive list of all costs that could be considered research and experimental. Examples of R&E costs include gross salaries and other payroll costs, overhead, heating, lighting, power, office supplies, laboratory materials, and software licenses used in R&E activities.

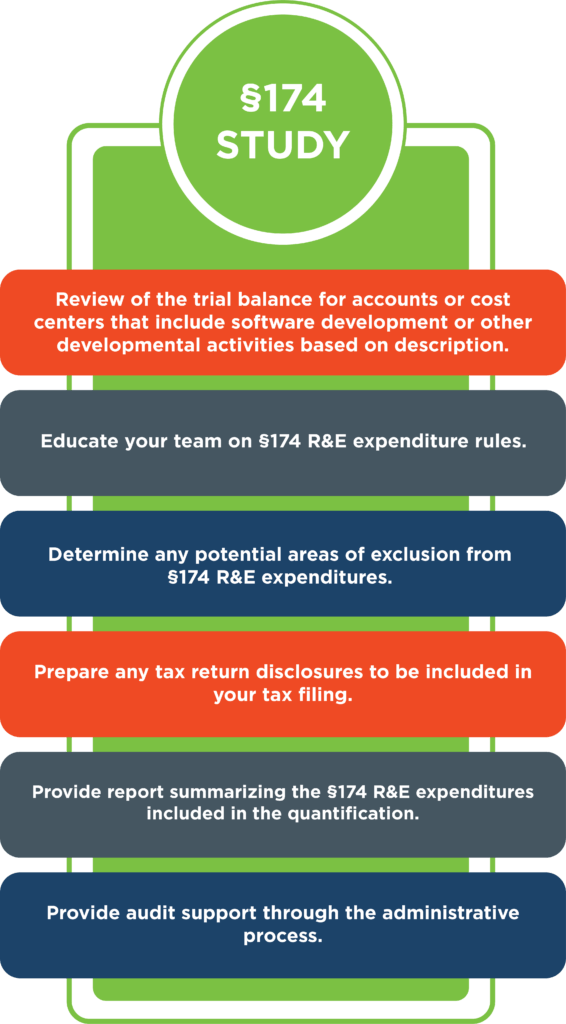

To assure compliance with current tax law, Source Advisors assists taxpayers in identifying departments and cost centers where Section 174 R&E activities are taking place.

An R&D credit calculation is claimed for direct research expenses such as wages, supplies, and contractor expenses. Section 174 includes these amounts but is also expanded to include certain indirect research costs such as facility costs, which are excluded from the R&D credit calculation.

In other words, all R&D tax credit expenses will qualify as a Section 174 expenditure, however not all Section 174 expenditures will attain the level of qualification needed to claim the R&D tax credit. Many companies will therefore have expenditures even if they do not claim the R&D tax credit.

Multinational businesses that incur research expenses in different countries should identify not only the money spent, but also the location where it was spent to properly track whether the expenses are subject to the five-year versus 15-year amortization period. The new amortization requirements may incentivize taxpayers to increase their US-based R&D activities, since these expenses may be amortized over 5-years rather than the 15-year requirement for foreign R&D expenses. These reviews may also identify opportunities to amend recent tax returns to capture unclaimed R&D tax credits.

While taxpayers will still receive the benefit for the R&E costs that are paid or incurred, these costs can no longer be fully deducted in the current tax year. The required amortization will create a timing difference that will impact cash flow. For example, if a taxpayer incurred $1,000,000 in Section 174 R&E expenditures in the 2022 tax year, the current year deduction will be $100,000 (i.e., 5 year amortization with half year convention), effectively creating a 90% reduction in deductions for 2022. This reduction would be even greater for foreign R&E costs.

Learn More

Join our industry leaders as they discuss the most recent updates with Section 174…

Watch Now →

The changes to Section 174 have a significant impact on software development…

Read More →

See how you can offset your client’s increased tax liability with R&D tax credits…

Download Now →

Due to bipartisan support in Congress for amending the changes to Section 174, we are optimistic that a fix will be implemented, although the timing remains uncertain. Taxpayers should be mindful of any estimated tax payments that are due when filing an extension.

You are obligated to amortize any research and experimental costs that fall under the broader definition of R&E as per Section 174, irrespective of whether you claim the R&D tax credit under Section 41. The two sections operate independently; therefore, even if a taxpayer discontinues claiming the tax credits under Section 41, they cannot avoid the requirement for amortization under Section 174. Due to the increase in tax liability resulting from this amortization, claiming the R&D tax credit can serve as a way to offset some of this additional financial burden.

All costs paid or incurred in relation to software development are now categorized as Research & Experimental (R&E) expenditures under Section 174. These costs are required to be capitalized and amortized over a period of not less than 5 years.

Get in touch with Source Advisors about our Section 174 services.

"*" indicates required fields