Solutions

Solutions

Cost Segregation Services & Consultants

Cost Segregation is a highly beneficial and widely accepted tax strategy utilized by owners of commercial and residential rental property to accelerate depreciation deductions, defer taxes, and improve cash flow. A quality study provides the appropriate documentation needed to support the correct classification of depreciable assets related to a building and exterior improvements. It is important to note that a Cost Segregation study does not create new deductions, it simply increases deductions in the early years of ownership. This front-loading of depreciation allows the taxpayer to take advantage of the time value of money.

From a tax perspective, Cost Segregation should be considered routine for all property owners who own or manage real estate. Not only will a study support accelerated depreciation by reclassifying eligible assets into shorter lives it but can provide valuable data to support important tax-centric initiatives during the holding period of the property.

A Cost Segregation study is a detailed analysis conducted by tax professionals, engineers, or specialized consultants to identify and separate the various components of a commercial or rental property for tax purposes. The objective of the study is to reclassify assets from longer depreciation periods to shorter ones, in order to accelerate tax deductions and improve cash flow for the property owner.

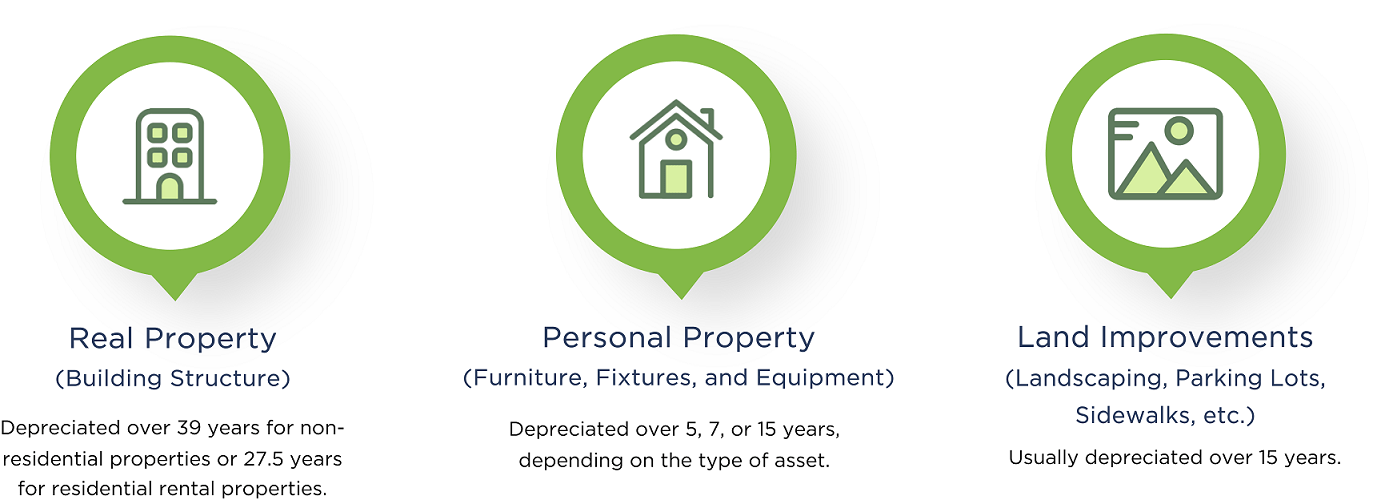

During a study, the property is thoroughly examined, and its components are categorized into different asset classes, each with its own depreciation schedule according to the IRS guidelines. These asset classes typically include:

By identifying and segregating these assets, these studies allow property owners to maximize their tax savings and increase cash flow. It’s important to note that a study should be performed by qualified professionals, as it requires a deep understanding of tax law, construction techniques, and engineering principles.

A Cost Segregation study helps to identify parts of a building or its improvements that can be depreciated faster, leading to tax savings. A building or its improvements may be eligible for such a study if:

The Cost Segregation landscape has evolved significantly over the past two decades. Now more than ever, property owners and accounting firms are seeking to work with established specialists such as Source Advisors.

One of the most noteworthy advancements in the Cost Segregation landscape was the introduction of industry standards by the American Society of Cost Segregation Professionals (ASCSP) in 2009. For the first time ever, the ASCSP established professional certifications, setting a high bar for expertise and ethical conduct in Cost Segregation studies.

In an industry where expertise and specialization are paramount, Source Advisors is proud to have a team that includes 6 ASCSP Certified members. While this number may seem small at first glance, it becomes highly significant when you consider that there are fewer than 50 Certified members across the nation.

Source Advisors remains committed to providing top-notch Cost Segregation services, leveraging our extensive experience and ASCSP-certified expertise to maximize your tax benefits.

Yes. At Source Advisors, we stand behind our Cost Segregation services. Our team provides unparalleled studies that result in meticulous attention to detail identifying construction-related costs.

A study typically takes 30-45 days to complete. The Source Advisors team will keep you up to date throughout the process and answer any questions you have regarding the services being conducted.

The more detailed information you can provide, the better. This ensures a more accurate estimate, and we might ask for additional information to clarify our understanding of your particular project and needs.

At minimum, we need:

Get in touch with Source Advisors about our Cost Segregation services.

"*" indicates required fields