Cost Segregation Case Study: Restaurants

Case Studies Cost Segregation for a Restaurant A Comprehensive Source Advisors Case Study Cost Segregation for a Stand Alone Franchise

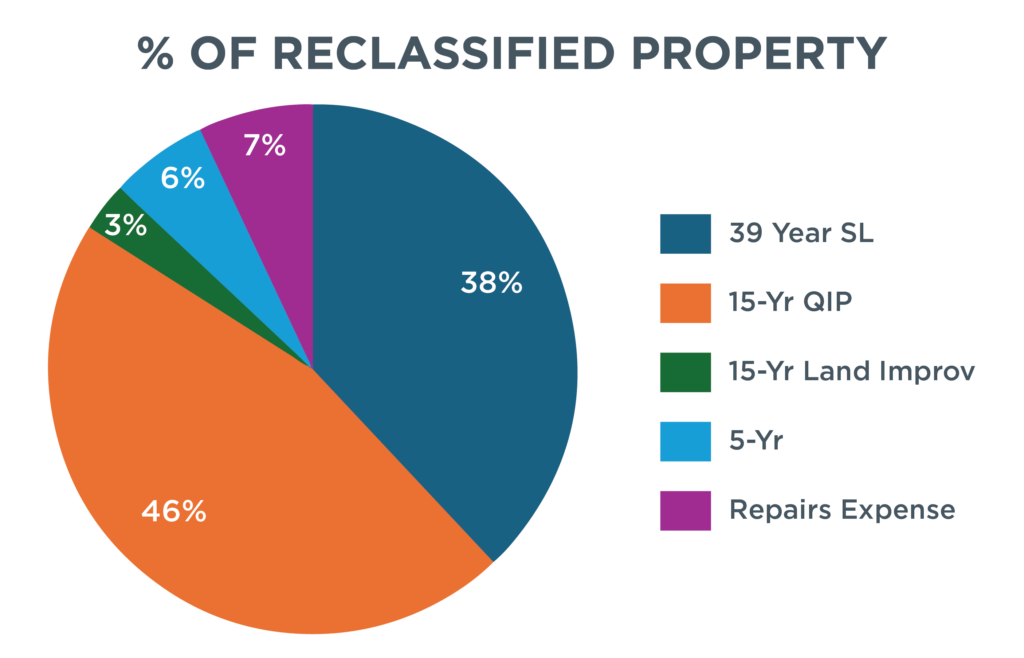

Source Advisors identified expenditures that met the requirements under the Tangible Property Regulations (TPR) to be treated as deductible repair costs. Expenditures deemed as a Betterment per the TPR were assigned to the proper MACRS (Modified Accelerated Cost Recovery) recovery periods, with several assets being eligible for Bonus Depreciation. These determinations were made by reviewing cost details, construction drawings, and from interviews with the property owner, and their knowledgeable representative. Additionally, assets originally placed in service that were removed in part or completely during the renovation were identified as dispositions. A detailed deliverable documenting all findings was provided to the client and their tax advisor for proper implementation during the preparation of the tax returns.

"*" indicates required fields

Through detailed Cost Segregation analysis, Source Advisors turned complex construction costs into massive tax savings for the auto dealership.

Don’t leave money on the table. Contact Source Advisors to find out how Cost Segregation can work wonders for your auto dealership’s bottom line.

Our industry experience with cost segregation has helped businesses claim billions of dollars in tax credits and incentives.

Our engineers excel at delineating construction costs to yield the highest tax benefits.

Our 40-year history of achieving substantial tax credit savings for clients across various industries is a testament to our commitment and expertise.

Our thorough reporting ensures every qualifying cost is adeptly reclassified.

Our dedicated support team is readily available to guide you through every step of the process, ensuring a smooth and stress-free experience.

Our recommendations stand in full compliance with tax legislations, offering clients unmatched peace of mind.

Case Studies Cost Segregation for a Restaurant A Comprehensive Source Advisors Case Study Cost Segregation for a Stand Alone Franchise

Case Studies Tangible Property Regulation for Multifamily A Comprehensive Source Advisors Case Study About the Multifamily The subject is an

Case Studies Cost Segregation for a Multi-Tenant Office Building A Comprehensive Source Advisors Case Study Cost Segregation for an Office

Case Studies Cost Segregation for Big Box Retail Centers A Comprehensive Source Advisors Case Study Cost Segregation for Big Box

Case Studies Cost Segregation for a Grocery Store A Comprehensive Source Advisors Case Study Cost Segregation for a Grocery Store

Case Studies Cost Segregation for a Restaurant A Comprehensive Source Advisors Case Study Cost Segregation for a Stand Alone Franchise