The owners of energy-efficient building property such as federal, state, or local governments (or a political subdivision thereof), and other tax-exempt entities may allocate the §179D tax deductions to the primary designer(s) of the building.

The primary designer is the person who creates the technical specifications for installation of energy-efficient commercial building property for a new building or addition/renovations to an existing building. Government property includes a wide variety of buildings such as public schools, universities, libraries, museums, convention centers, prisons, etc.

179D deduction for design firms has been expanded to buildings owned by specified tax-exempt entities, including certain government entities, Indian tribal governments, Alaska Native Corporations, and other tax-exempt organizations.

Property Type

School

Number of Floors

2

Area (SF)

93,185

Location

Austin, Texas

Building Envelope

CMU Wall with Gypsum Board

Insulated Metal Deck

Low-E Glazing

HVAC

Geothermal Water Source Heat Pump

Lighting

Energy Efficient LED; LPD – 0.51 W/SF

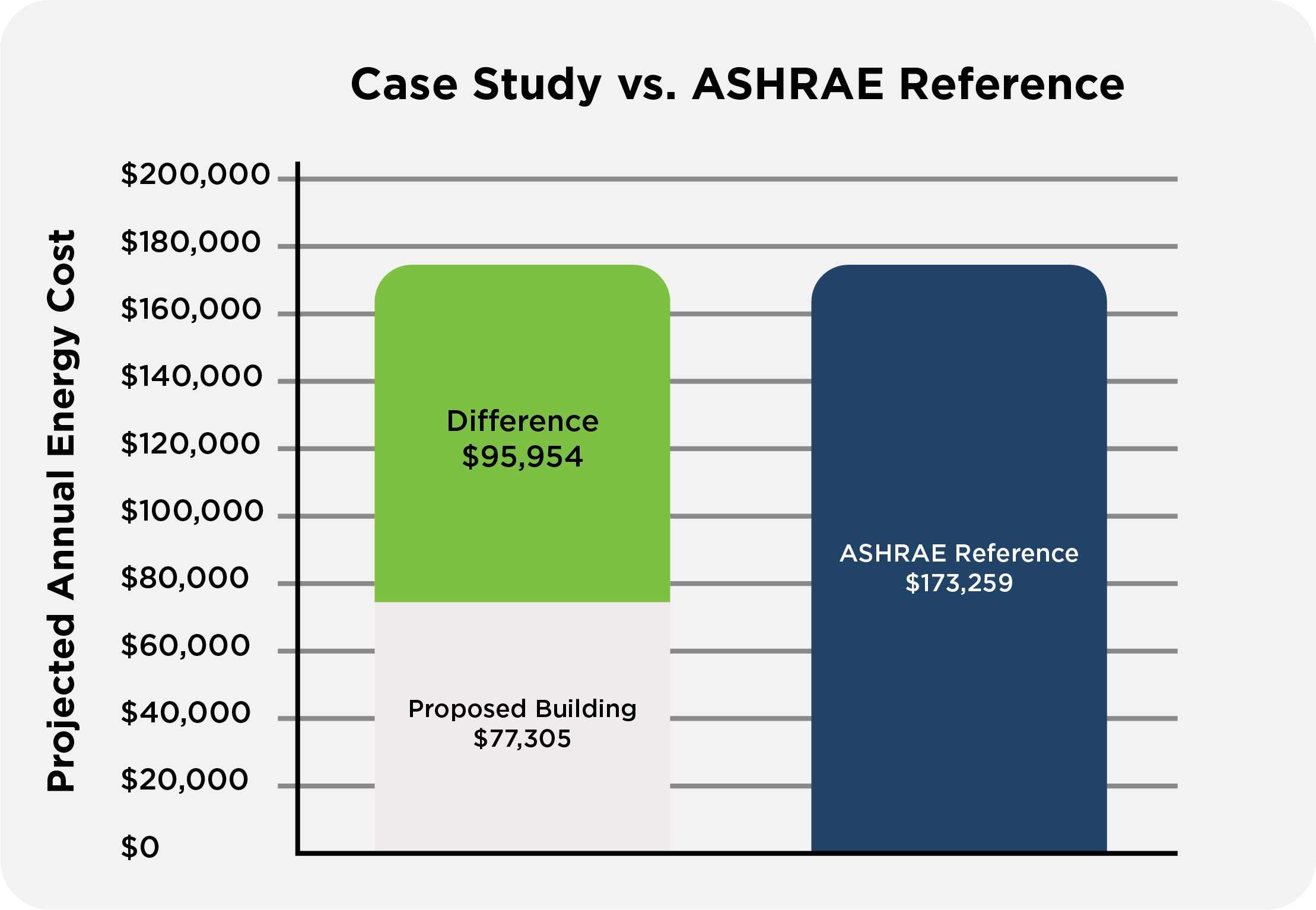

The Source Advisors §179D engineers were engaged to analyze and certify the building as per §179D guidelines. They reviewed the building’s envelope, interior lighting, HVAC, and service hot water systems and modeled them using IRS approved software. The proposed building energy costs were compared to the ASHRAE 90.1-2007 reference building.

The engineering team thoroughly evaluated various qualifying methods (full building qualifications, partial qualifications, and Interim Lighting Rule) to calculate the maximum tax deduction that the building would qualify for.

For the subject property opting for Interim Lighting, the tax deduction varies linearly from $0.30/SF at 25% savings to $0.60/SF at 40% savings. The report provides a complete and detailed description of our analysis, results, techniques, definitions, assumptions, and limiting conditions. Our results were based on information that was provided to us and includes, but is not limited to, drawings and specifications.

Based on the energy model and the site inspection, Source Advisors qualified the subject property for the envelope, HVAC and service hot water, and interior lighting systems.

The total area of the building is 93,185 square feet. The projected annual energy costs for the subject building using the methods prescribed by the IRS is $77,305. The projected annual energy costs for the ASHRAE Reference building is $173,259. The property achieved 55.4% savings (excluding the process loads) in annual energy costs.

The subject property qualified under the full building qualification for §179D tax deductions of $1.80/SF or $167,733.

Projected Annual Energy Savings

$95,954

Achieved Savings Over Reference

55.4%

§179D Tax Deductions $/SF

$1.80

§179D Tax Deductions

$167,733

Embrace the power of tax credit savings with Source Advisors and propel your business towards growth and success. Partner with us today to unlock your company’s full potential.