Commercial building owners that incorporate energy efficient design for new construction or major renovation projects, can qualify for the §179D tax deduction. This tax incentive provides a deduction of up to $5.00/SF for taxpayers meeting specific energy-efficient building requirements. Commercial property includes a wide variety of categories such as office buildings, manufacturing facilities, warehouses, auto-dealerships, event centers, hotels, and retail stores.

Property Type

Commercial

Number of Floors

1

Area (SF)

59,000

Location

Houston, Texas

Building Envelope

Cavity Wall with Batt Insulation

Rigid Insulation with Exterior Sheathing

Low-E Glazing

HVAC

Packaged AHUs; Air Conditioning Units

Lighting

Energy Efficient LED; LPD – 0.34 W/SF

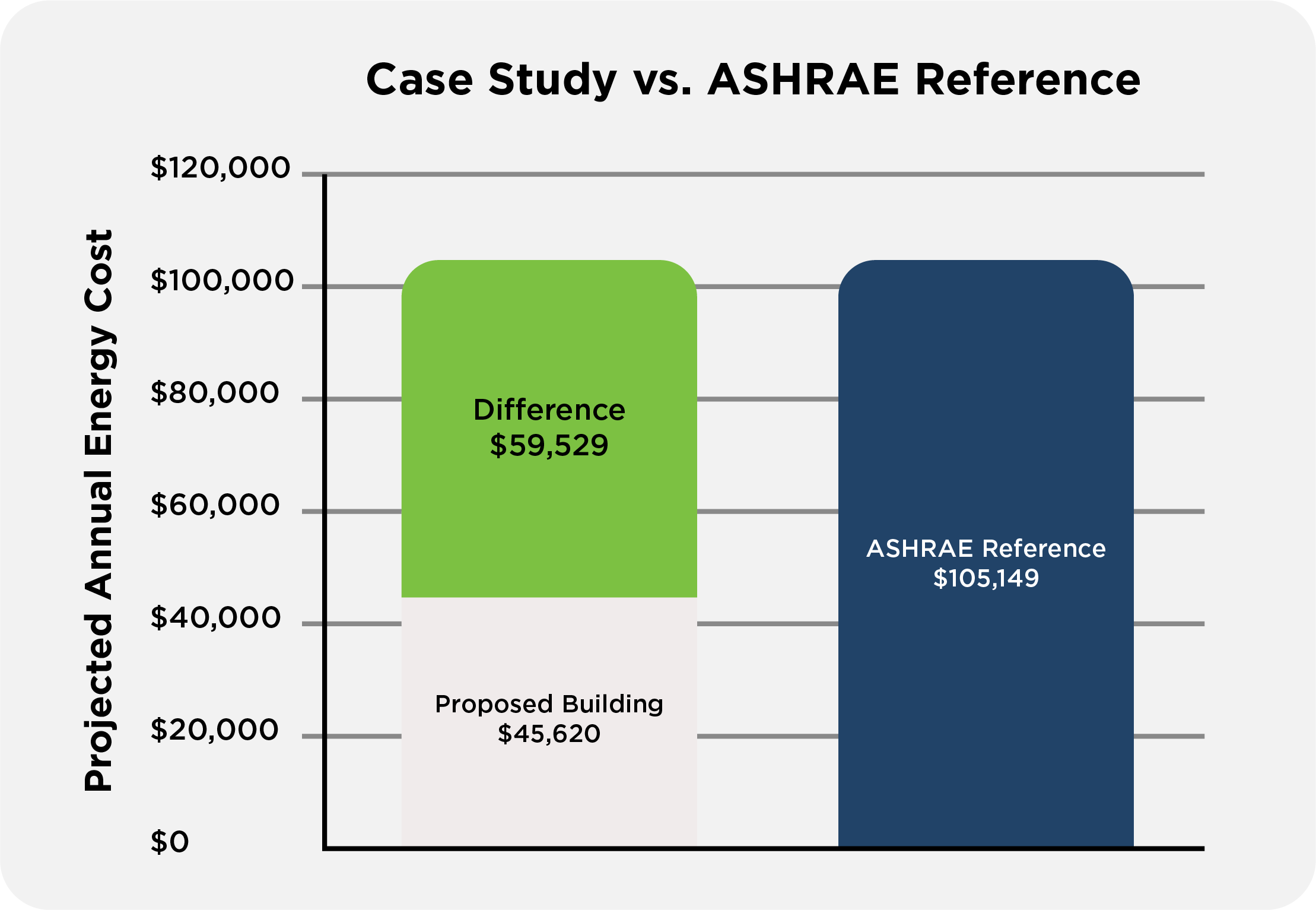

The Source Advisors §179D engineers were engaged to analyze and certify the building as per §179D guidelines. They reviewed the building’s envelope, interior lighting, HVAC, and service hot water systems and modeled them using an IRS approved software. The proposed building energy costs were compared to the ASHRAE 90.1-2007 reference building.

The engineering team thoroughly evaluates various qualifying methods (full building qualification, partial qualifications, and Interim Lighting Rule) to calculate the maximum tax deduction that the building would qualify for.

Based on the energy model and the site inspection, Source Advisors qualified the subject property for the Envelope, HVAC and service hot water and interior lighting systems.

The total area of the building is 59,000 square feet. The projected annual energy costs for the subject building using the methods prescribed by the IRS is $45,620. The projected annual energy costs for the ASHRAE Reference building is $105,149. The property achieved 56.6% savings (excluding the process loads) in annual energy costs.

The subject property qualified under the full building qualification for §179D tax deductions of $5.00/SF or $295,000.

Projected Annual Energy Savings

$59,529

Achieved Savings Over Reference

56.6%

§179D Tax Deductions $/SF

$5.00

§179D Tax Deductions

$295,000

Embrace the power of tax credit savings with Source Advisors and propel your business towards growth and success. Partner with us today to unlock your company’s full potential.