Treatment of Tenant Improvements & Section 110 Overview

As we have discussed in a prior installment of iTaxblog, the Tangible Property Regulations have focusedpractitioners’ attention on the treatment of tenant improvements. This new focus has led practitioners to pay more attention to existing issues with the leasing of property, especially how section 110 treats construction allowances. Before examining how section 110 and the TPR interact, it is important to understand the tax treatment of tenant improvements under prior law.

Prior Law Overview

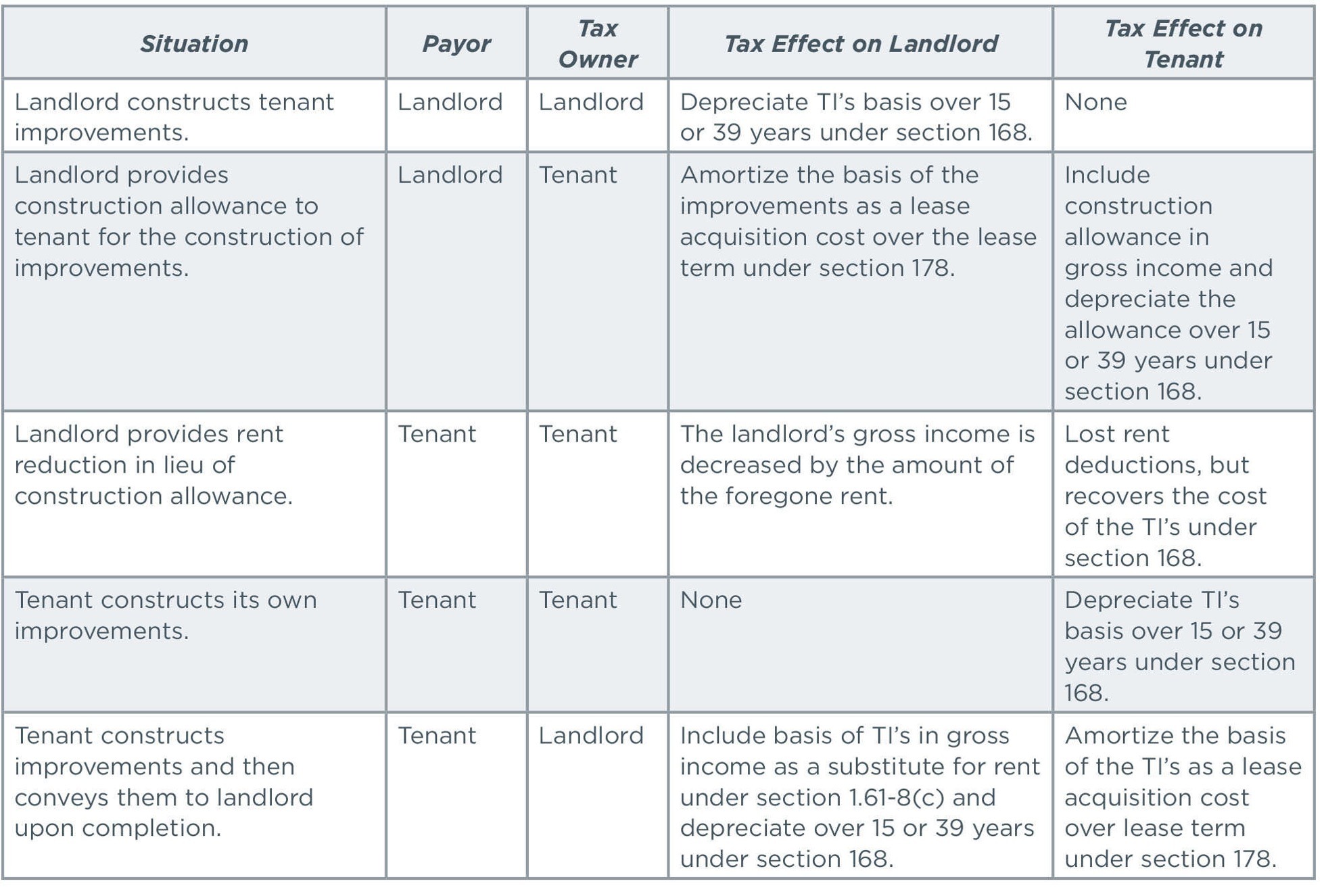

The chart captures the tax treatment of the tenant improvements (TI’s) under prior law. (Please note that the chart makes certain assumptions about the drafting of the lease agreement and that section 467 does not apply.)

Code Section 110

As shown in the above chart, if a tenant receives a construction allowance, the tenant generally must include the amount of the allowance in income if it is the tax owner of the improvements. Given this harsh treatment, in 1997 Congress added section 110 to the Code. This Code section provides limited relief to tenants who receive construction allowances for certain short-term, retail leases.

Though this section has been in place for almost 20 years, taxpayers rarely have qualifying leases. This is due to the many requirements for the section to apply..

- Under section 1.110-1(b)(3), the lease agreement must expressly provide that the construction allowance is for the purpose of constructing or improving qualified long-term real property for use in the lessee’s trade or business at the retail space. If the original lease agreement does not include this provision, the taxpayer has until the payment of the construction allowance to enter into an ancillary agreement with the provision.

- The lease must be short-term, which is fifteen years of less.1

- The lease must be for retail space, which is qualified long-term real property used by the lessee in its trade or business of selling tangible personal property or services to the general public. Retail space includes back office and storage areas plus showroom or sales areas.2

- The qualified long-term real property is nonresidential real property that reverts to the lessor at the end of the lease. It does not include section 1245 property.3

- The lessor must have consistent tax treatment.4

- Both the lessor and lessee must include in their timely filed tax returns a statement that includes the other party’s name, EIN, and address; the location of the retail space, including any location and store names; the amount of the construction allowance and the amount treated as for nonresidential property owned by the lessor.5

Section 110 has become more prominent in recent years, since the Tangible Property Regulations provide specific rules relating to it. Specifically, lessees must capitalize all related amounts it pays to improve leased property unless section 110 applies to a construction allowance or the improvements were a substitute for rent.6 Similarly, lessors must capitalize the related amounts it pays for improvements to leased property, including via a section 110 construction allowance.7

- Treas. Reg. section 1.110-1(b)(iii)(2)(ii).

- Treas. Reg. section 1.110-1(b)(iii)(2)(iii).

- Treas. Reg. section 1.110-1(b)(iii)(2)(i).

- Treas. Reg. section 1.110-1(b)(5).

- Treas. Reg. section 1.110-1(c).

- Treas. Reg. section 1.263(a)-3(f)(2)(i).