Last In, First Out (LIFO) Inventory Method: Pros and Cons

![]() Sara Richardson

on

May 30, 2024

Sara Richardson

on

May 30, 2024

Inventory valuation is an accounting process used by companies to assign value to their inventory. It determines the cost of unsold goods at the close of an accounting period and plays a critical role in calculating the cost of goods sold (COGS) and the gross profit for the period.

The main reason for this process is to assign a monetary value for a company’s inventory items at the close of a reporting period. There are several methods used for inventory valuation. Each method affects the financial statements differently, especially under varying market conditions.

Advantages of LIFO

The LIFO (Last-In, First-Out) accounting method assumes that the inventory items most recently purchased are the first ones sold or used, which means that the COGS is calculated using the most recent inventory costs, leaving older inventory costs in the ending inventory balance.

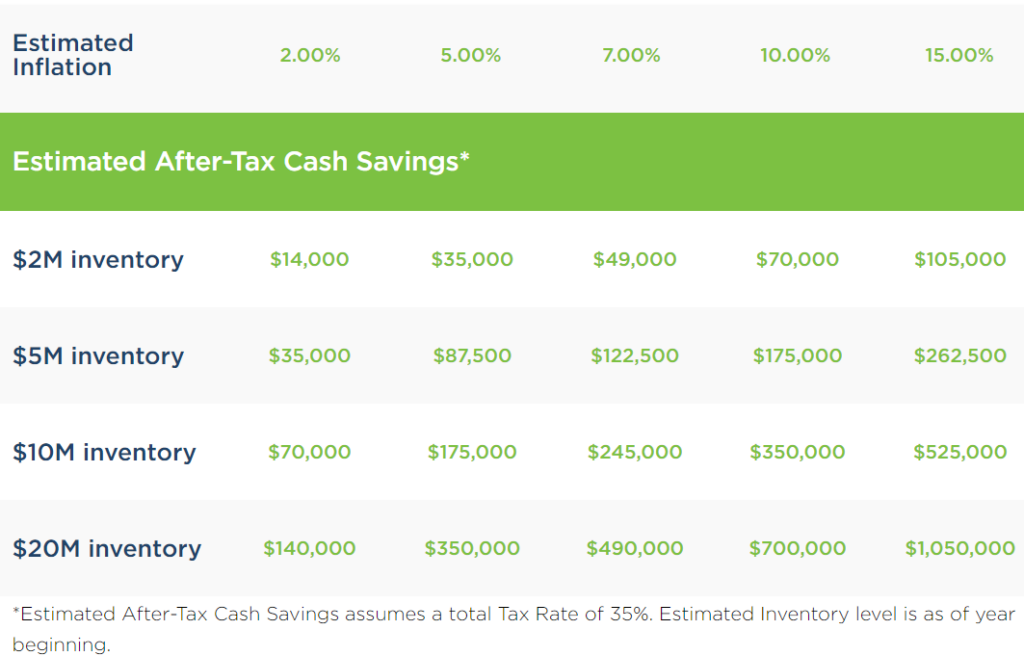

Tax Savings & Cash Flow Improvement

- LIFO can lead to lower cost of goods sold (COGS) during inflation.

- LIFO can result in lower taxable income in times of inflation because it matches higher current prices with current sales, thereby reducing reported profits and tax liabilities.

- Cash flow can be improved by deferring taxes since LIFO reports lower profits in times of rising prices.

Disadvantages of LIFO

Although there are several benefits to using the LIFO accounting method, there are also disadvantages that are important to note.

- LIFO may not reflect the actual cost of remaining inventory, especially during periods of inflation.

- LIFO calculations can be more complex compared to FIFO (First-In-First-Out). Because of the complexities of this method, there will potentially be a need for additional record-keeping.

- LIFO is not allowed under some international accounting standards (IFRS).

Disadvantages of LIFO

Although there are several benefits to using the LIFO accounting method, there are also disadvantages that are important to note.

- LIFO may not reflect the actual cost of remaining inventory, especially during periods of inflation.

- LIFO calculations can be more complex compared to FIFO (First-In-First-Out). Because of the complexities of this method, there will potentially be a need for additional record-keeping.

- LIFO is not allowed under some international accounting standards (IFRS).

Because of the pros and cons of this accounting method, it is critical for businesses to select a provider that understands the complexities of LIFO and that has a deep understanding of their financial goals. With Source Advisors as a trusted partner, businesses can tap into the nuances of this method and determine whether it fits into their overall business strategy.