For businesses in multiple industries

looking to reduce Federal and State tax liability.

The R&D tax credit, also known as the Research and Development tax credit, was created as a way to incentivize US-based research and development activity. The Protecting Americans from Tax Hikes (PATH) Act in 2015 made this a permanent tax credit and extended the benefits to startup companies. The credit enables businesses of all sizes to reduce their federal income tax for qualified research expenses. These expenses must be for qualified research activities.

Claiming the R&D tax credit can potentially result in significant cost savings. The benefits include:

A taxpayer can claim an R&D tax credit, on either their timely filed tax return including extensions for a given year or a taxpayer can go and amend prior returns to claim the credit. For amended tax returns, this can typically be claimed for the previous 3 years.

The credit is claimed by filing IRS Form 6765, Credit for Increasing Research Activities (for the year in which the qualified expenses were paid or incurred).

At Source Advisors, we typically rely on accounting data or time data to understand the research taking place, which is summarized by employee, project, and specific activities being performed. If the time is broken down into tasks, we can look to see if that specific activity qualifies by looking back on the construction stages. Through analyzing the time tracking data, we are able to help identify the main tasks where R&D is taking place and determine a reasonable percentage of time applied toward any specific employee’s wages.

The Protecting Americans from Tax Hikes (PATH) Act of 2015 included provisions that allow small and mid-sized taxpayers to offset their Alternative Minimum Tax (AMT) liability with the R&D tax credit for taxable years beginning on or after Jan 1, 2016.

Previously, qualified companies could be limited by AMT and unable to utilize 100% of the R&D tax credit. Instead, any excess credits had to be carried back and then forward. However, the PATH Act makes it possible for small businesses to offset their Alternative Minimum Tax through the R&D tax credit. So for tax years beginning after December 31, 2015, there is no limitation.

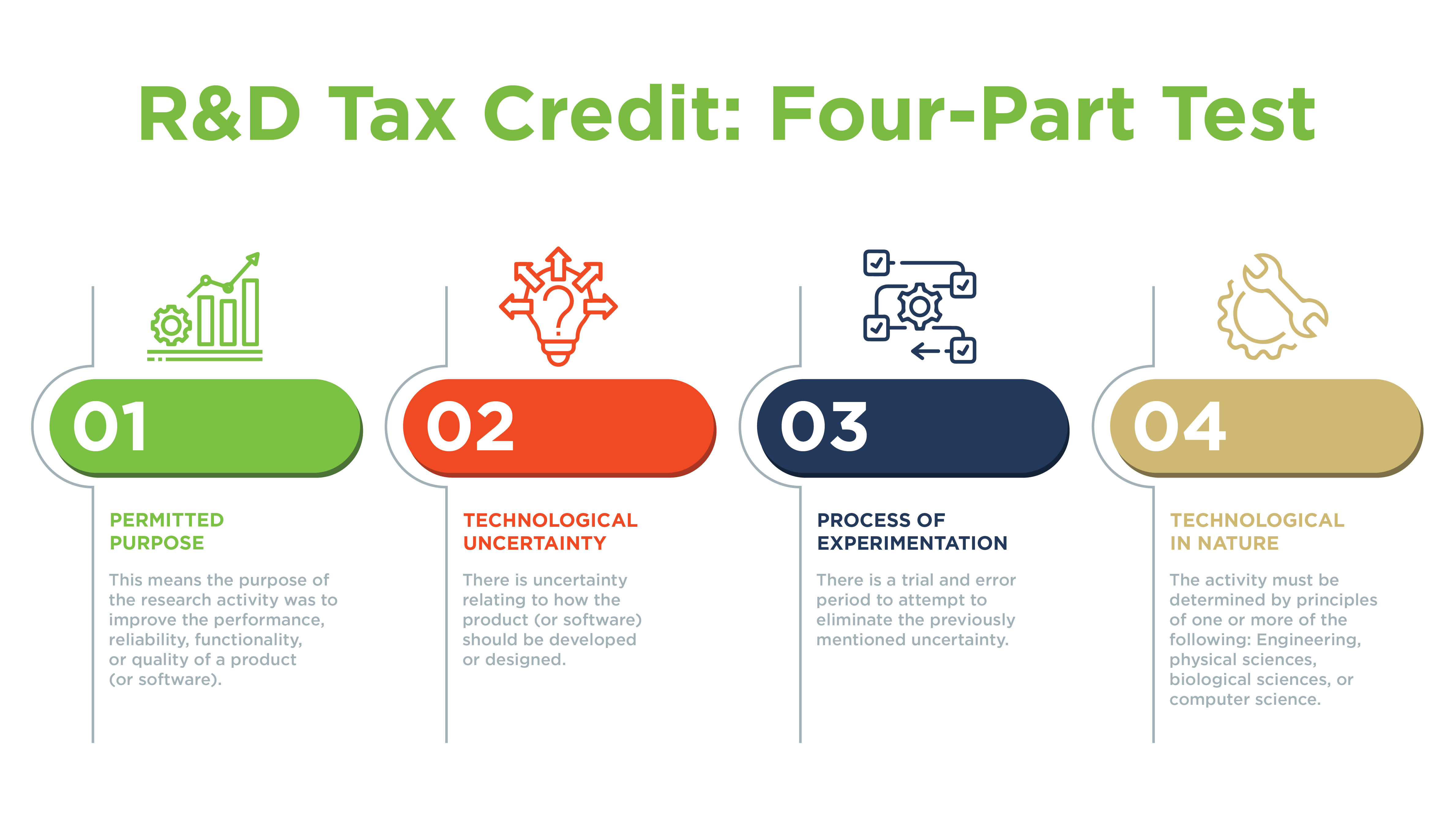

Documentation is extremely important to defending any R&D tax credit claims. This includes having a permitted purpose, technological uncertainty, the process of experimentation, and being technological in nature.

During a cost segregation study, the property is thoroughly examined, and its components are categorized into different asset classes, each with its own depreciation schedule according to the IRS guidelines. These asset classes typically include:

There are two methods a taxpayer can choose from when computing the R&D tax credit: The Regular Credit (RC) Method and the Alternative Simplified Credit (ASC) Method. Taxpayers can generally choose the most preferential calculation method each year.

Both methods offer specific advantages and disadvantages. Our team at Source Advisors can determine the best calculation method based on your specific situation.

There are four sections of IRS Form 6765 that must be evaluated:

The first section is for any business attempting to claim the R&D credit using the RC method.

This section is for businesses electing to utilize the ASC calculation method.

This section contains further documentation based on your specific business setup.

This section is required for any small business that falls under the payroll tax election.

Source advisors assists taxpayers in identifying departments and cost center where Section 174 R&E activities are taking place.

Our Enhanced R&D Tax Credit studies include Section 174 study to ensure compliance and to help reduce tax liability.

The R&D tax credit can help a wide variety of businesses offset and reduce their income tax liability, in addition to providing many other benefits. At Source Advisors, we can help assess your company’s federal R&D tax credit opportunity and also determine any state R&D tax credit availability. Our team of experienced CPAs, attorneys, engineers, and technology experts helps companies save money and create cash flow with R&D tax credits that can then help drive overall growth.

Learn More

Request an enhanced R&D Tax Credit study that includes a Section 174 study to ensure compliance and to help reduce tax liability

Read More →

Automate your R&D tax credits with GOAT.tax

Read More →

We help businesses based in the UK claim R&D Tax Credits

Read More →