Cost Segregation Case Study: Big Box Retail Center

Case Studies Cost Segregation for Big Box Retail Centers A Comprehensive Source Advisors Case Study Cost Segregation for Big Box

The taxation realm for banking institutions can be intricate, offering both challenges and avenues for savings. This case study showcases how Source Advisors harnessed Cost Segregation to metamorphose the bank’s construction costs into notable tax advantages.

Our focal point is a bank, constructed in 2019 at a cost of $2,400,000. The one-story, steel-framed structure featured exterior travertine panels and a built-up roof. Inside, it was equipped with four teller windows, bank vault doors, pneumatic tube systems, tile flooring, decorative millwork, and acoustical ceiling tiles.

Key enhancements to the site encompassed asphalt paving, landscaping, fencing, sidewalks, site drainage, and lighting, adding layers of functionality and aesthetics to the bank’s premise.

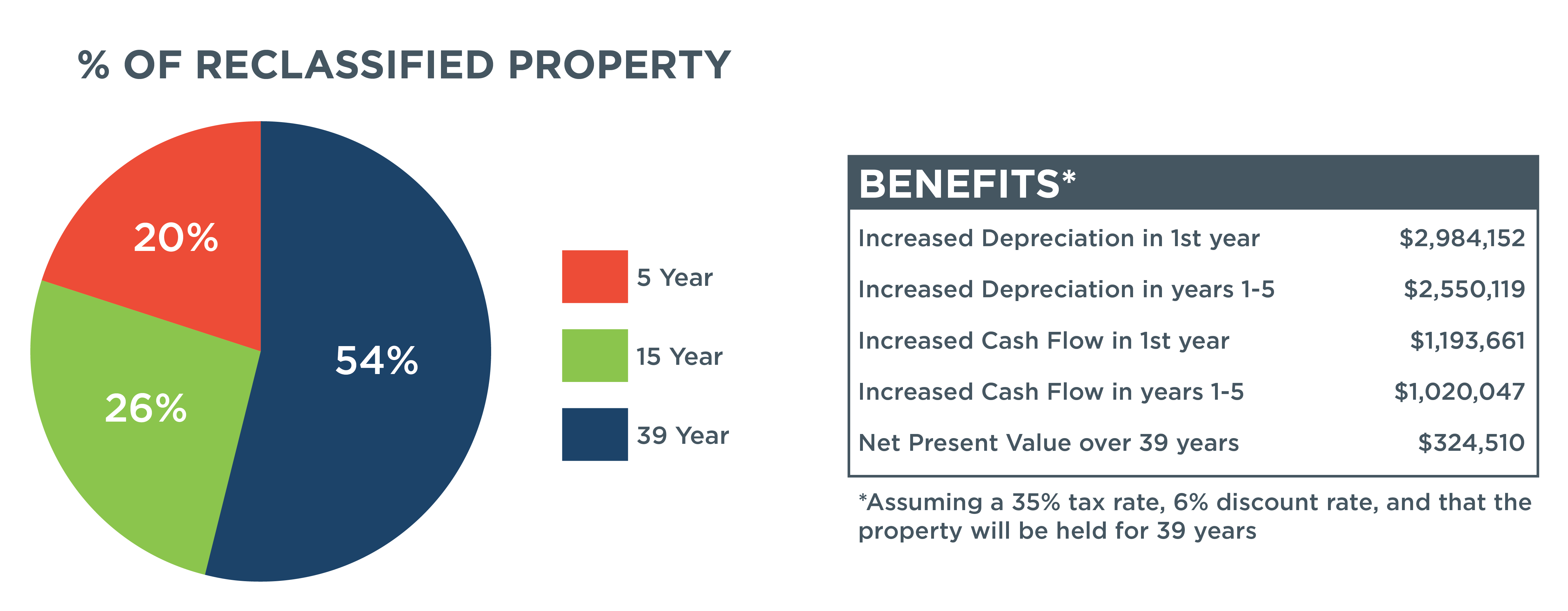

The Source Advisors Cost Segregation engineers analyzed the construction costs, in the form of contractor invoices, and allocated the cost detail to various trades and building components.

Our engineers conducted detailed estimates from the construction drawings and augmented those findings with additional estimates performed during the site visit of the property. Key property personnel were also interviewed, and a detailed report was delivered, identifying and documenting all of the components that qualify for a shorter tax life.

"*" indicates required fields

By employing an in-depth Cost Segregation analysis, Source Advisors successfully translated the bank’s complex construction expenditures into significant tax reductions.

Don’t leave money on the table. Contact Source Advisors to find out how Cost Segregation can work wonders for your banks bottom line.

Our industry experience with cost segregation has helped businesses claim billions of dollars in tax credits and incentives.

Our engineers excel at delineating construction costs to yield the highest tax benefits.

Our 40-year history of achieving substantial tax credit savings for clients across various industries is a testament to our commitment and expertise.

Our thorough reporting ensures every qualifying cost is adeptly reclassified.

Our dedicated support team is readily available to guide you through every step of the process, ensuring a smooth and stress-free experience.

Our recommendations stand in full compliance with tax legislations, offering clients unmatched peace of mind.

Case Studies Cost Segregation for Big Box Retail Centers A Comprehensive Source Advisors Case Study Cost Segregation for Big Box

Case Studies Cost Segregation for a Data Center A Comprehensive Source Advisors Case Study Cost Segregation for Data Centers In

Case Studies Cost Segregation for Auto Dealerships A Comprehensive Source Advisors Case Study Cost Segregation for Auto Dealerships The tax