The Current State of ADS Under the TCJA and CARES ACT

Introduction to the ADS

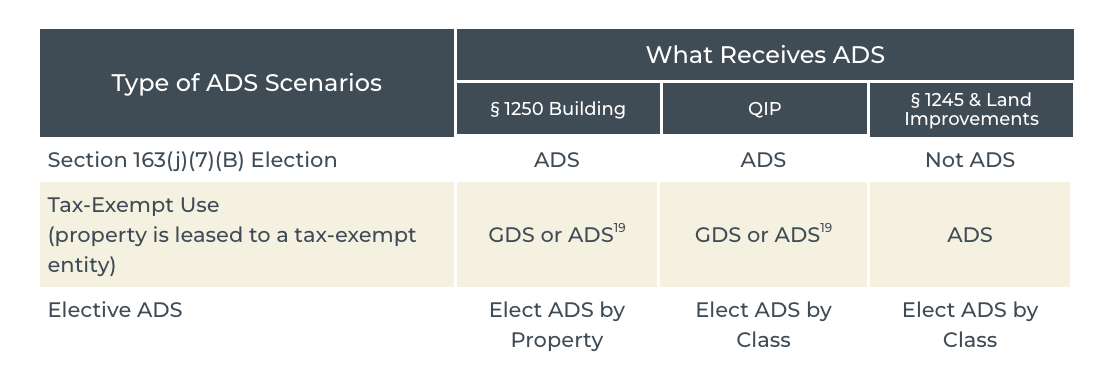

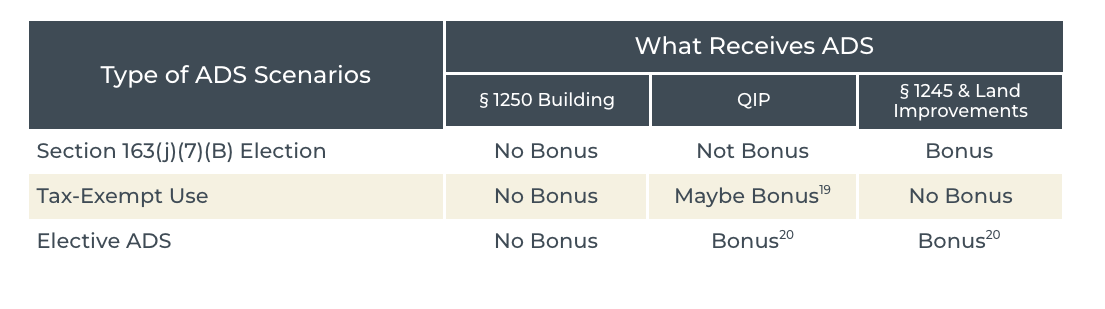

The Alternative Depreciation System is part of the Modified Accelerated Cost Recovery System (“MACRS”).1 It stands in contrast to the General Depreciation System (“GDS”) of Code section 168(a).2, Under the ADS, all property must use the straight-line method of depreciation.3 While ADS property uses the same depreciation conventions as the GDS,4 it generally must use longer recovery periods.5 ADS property generally does not qualify for bonus depreciation.6 Common types of ADS property include property used predominantly outside the United States, tax-exempt bond-financed property, certain property owned by businesses making elections under Code section 163(j)(7), tax-exempt use property, and property for which the ADS has been elected. Our discussion will be limited to the last three scenarios.

Section 163(j)(7) Elections

The Tax Cuts and Jobs Act (“TCJA”) modified Code section 163(j) to limit business interest deductions to the sum of business interest income plus 30%7 of adjusted taxable income (“tax EBITDA”) plus floorplan financing interest. Interest deductions disallowed under this provision are carried forward. Certain taxpayers, such as real property trades or business or farmers, could make an election to take unlimited business interest deductions in the current year.8 These elections are irrevocable, and, in both cases, the unlimited interest deductions provided by these elections came at the cost of bonus and accelerated depreciation on certain assets due to the resulting ADS classification.

- For electing real property trades or businesses, ADS applies to:

- nonresidential real property

- residential rental property, and

- Qualified Improvement Property (“QIP”).9

- For electing farming businesses, ADS applies to property with a recovery period of ten or more years.10

Highly leveraged taxpayers in these industries often make these elections, which has spread ADS property classifications to many new taxpayers.

For more information regarding section 163(j), please refer to out technical update from April 2020 titled Rev. Proc. 2020-22 Changes to the Section163(j) Interest Limitation. In it we discuss how the new revenue procedure provides guidance allowing taxpayers to make or revoke certain elections under Code section 163(j) and also provides guidance on the implementation of the interest limitation as revised by H.R. 748, the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act, Public Law No. 116-136.

Tax-Exempt Use Property

Another common type of ADS property is tax-exempt use property. Building owners encounter this bewildering MACRS provision when they lease to tax-exempt entities. Applying the ADS rules to a tax-exempt tenant involves two separate approaches, which depends on the type of asset and the facts and circumstances surrounding the lease.

1. For tangible personal property and land improvements, just being leased to a tax exempt entity means that these assets must use ADS recovery periods.11

2. For nonresidential real property, the taxpayer must determine whether a large enough portion of the building is leased to a tax-exempt tenant (or tenants) in a disqualified lease (or leases).12

- The taxpayer first applies a square footage test. If more than 35% of the building is leased to tax-exempt entities, then the taxpayer looks at the leases to see if they are considered “disqualified”.

- A lease is disqualified if:13

- The tax-exempt entity participated in financing the property, directly or indirectly,

using tax-exempt obligations. - The tax-exempt entity has a fixed or determinable price purchase or sale option.

- The lease is longer than 20 years, including non-FMV renewal options).14

- Or the lease is part of a sales-leaseback transaction from the tax-exempt entity (or

a related entity).

- The tax-exempt entity participated in financing the property, directly or indirectly,

The disqualified lease rules also apply to former Qualified Leasehold Improvement Property15 and QIP.16 In both cases, these property types are analyzed alongside the underlying building.

Elective ADS Property

The final category of commonly encountered ADS property is elective ADS property. Code section 168(g)(7) allows a taxpayer to irrevocably elect the ADS. Taxpayers make this election on a classby-class basis or, for buildings, on a property-by-property basis.17 Taxpayers make the election by completing Line 20 of Form 4562 for the property or class. Unlike other ADS property, elective ADS property is eligible for bonus depreciation provided all other requirements are met.18

Bonus Depreciation and ADS

When working with ADS property, tax advisors often assume that all assets must follow ADS if some assets do. This is not necessarily the case.

Opportunities for bonus depreciation, as we mentioned above, are often overlooked under the current rules.

Real World Examples

Example 1

Example 2

If the tenant is tax-exempt, it is often easier to work through the disqualified lease tests before applying the square footage test. (If there are no disqualified leases, the square footage is irrelevant, which can save a great deal of analysis in a multi-tenant situation.) If there are no disqualified leases, the taxpayer would use a 15-year recovery period for the tax-exempt tenant’s QIP and receive bonus depreciation if qualified. Unfortunately, tangible personal property and land improvements leased to the tax-exempt tenant would use ADS and remain ineligible for bonus depreciation.

Example 3

1 See I.R.C. § 168(g).

2 See Rev. Proc. 87-57, § 3.02.

3 I.R.C. § 168(g)(2)(A).

4 I.R.C. § 168(g)(2)(B).

5 See I.R.C. § 168(g)(2)(C).

6 See I.R.C. § 168(k)(2)(D).

7 Or 50% for taxable years beginning in 2019 or 2020 (with limitations for partnerships).

8 See I.R.C. § 163(j)(7).

9 I.R.C. § 168(g)(8).

10 I.R.C. § 168(g)(1)(G)

11 I.R.C.§ 168(h)(1)(A); see also CCA 201436048 (Sep. 5, 2014).

12 I.R.C. § 168(h)(1)(B)(i).

13 I.R.C. § 168(h)(1)(B)(ii).

14 See I.R.C. § 168(i)(3)(A)(i).

15 CCA 201436048 (Sep. 5, 2014).

16 I.R.C. § 168(h)(1)(B)(iv).

17 I.R.C. § 168(g)(7).

18 I.R.C. § 168(k)(2)(D)(i).

19 See two-part test above.

20 If no election out of bonus for this class of property.

21 As we understand it, this is sometimes due to software errors.