Services

179D Tax Deduction for Energy Efficient Commercial Buildings

"*" indicates required fields

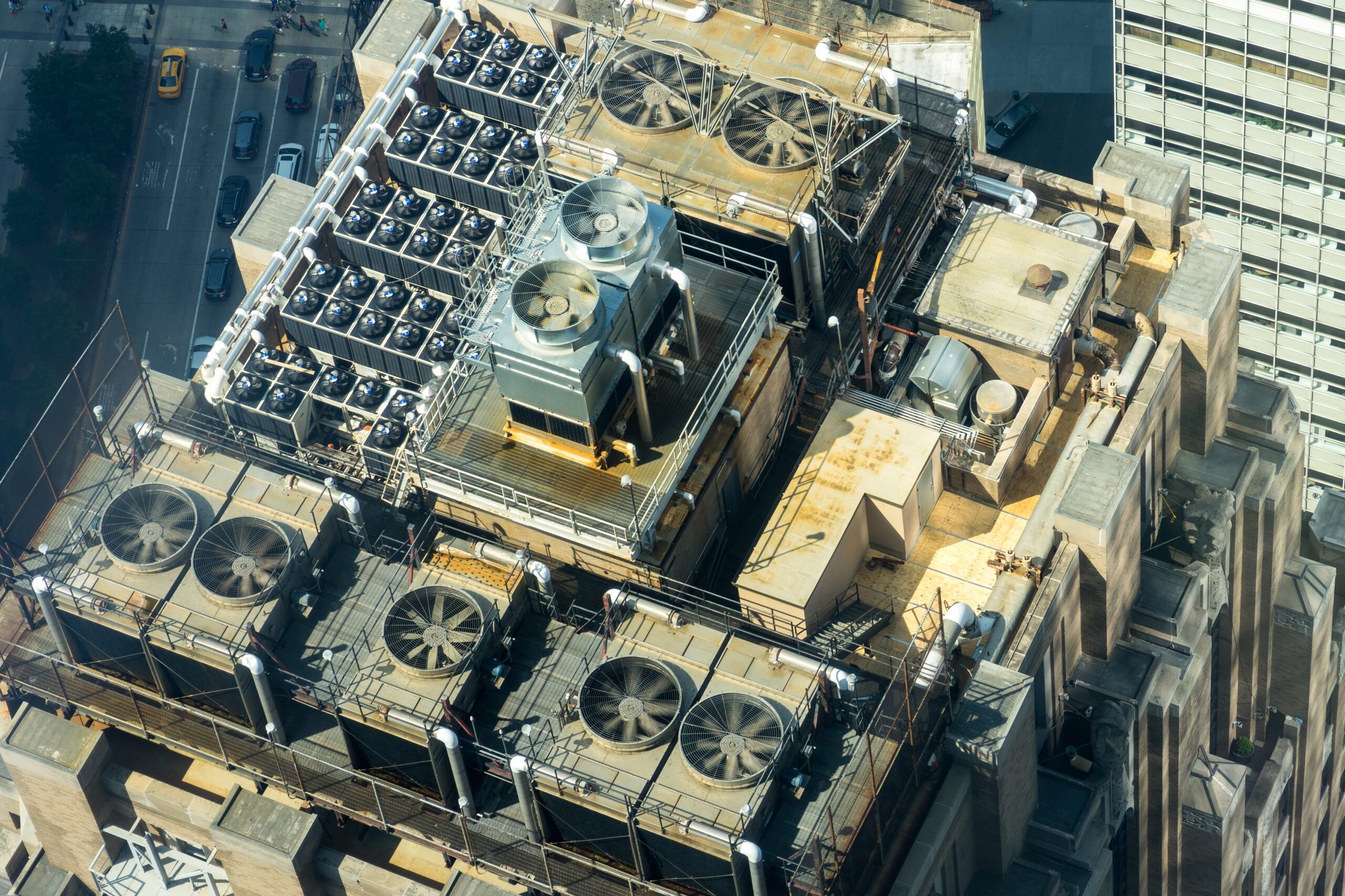

Section 179D is a provision in the U.S. tax code that was specifically designed to incentivize energy efficiency. It was enacted by the Energy Policy Act of 2005, and it provides a tax deduction for business property owners who make certain energy-efficient upgrades to their buildings. If a commercial or high-rise residential (4+ stories) building owner installs property improvements that reduce energy and power costs, they may be eligible for this tax deduction. The improvements can include better insulation, energy-efficient lighting, or heating, ventilation, and air conditioning (HVAC) systems that consume less energy.

The deduction is calculated based on the square footage of the building and the energy cost savings achieved by these improvements. It’s also worth noting that the Section 179D deduction is not just for building owners. Certain designers, such as architects, engineers, and contractors, can also take this deduction for public buildings, such as schools or government offices

As energy costs rise, reducing those costs is a priority for most public and private organizations. Source Advisors helps building owners and design firms understand and fully leverage this incentive.

The Energy Policy Act (EPAct) 179D tax deduction provides a deduction of up to $1.80/SF for the installation of systems that reduce the total energy and power costs by 50% in comparison to a building meeting minimum requirements set by ASHRAE Standard 90.1 for buildings Placed in Service in 2020 or prior.

For buildings Placed in Service in 2023, the building owners can potentially receive a full deduction up to $5.00/SF for installation of systems that can achieve a minimum of 25% energy savings in comparison to a building meeting minimum requirements set by ASHARE Standard 90.1.

$0.61/sqft up to $1.82/sqft

$0.63/sqft up to $1.88/sqft

$2.68/sqft up to $5.36/sqft

Eligible building systems include the building envelope, interior lighting systems, heating, cooling, ventilation, and hot water system.

Before 1/1/2015

After 12/31/2014 and before 1/1/2027*

After 12/31/2026*

Reference Standard 90.1-2001

Reference Standard 90.1-2007

Reference Standard 90.1-2019

*Taxpayers who begin construction before 1/1/2023 may apply Reference Standard 90.1-2007 regardless of when the building is placed in service.

Prior to 2023, to qualify for a full or partial deduction, the energy-efficient building must meet the following criteria:

If your design doesn’t meet the 50% energy savings, it could still qualify for a partial deduction if they meet the following criteria:

In addition, the IRS provides Interim Lighting Rules as an alternative method of evaluation. These rules allow a watts-per-square-foot calculation or a lighting-power-density calculation to be used in lieu of modeling when measuring energy efficiency.

After 2022, to qualify for a full or retrofit deduction, the energy-efficient building property must meet the following criteria:

25% (minimum)

30%

35%

40%

50% (maximum)

50 cents per ft²

60 cents per ft²

70 cents per ft²

80 cents per ft²

$1.00 per ft²

$2.50 per ft²

$3.00 per ft²

$3.50 per ft²

$4.00 per ft²

$5.00 per ft²

The allocation of the deduction by government agencies to designers has now been expanded to allow other tax-exempt entities to allocate the deduction to a designer.

You would need to obtain an allocation letter from that government entity that transfers the Section §179D benefit directly to you. At Source Advisors, our team handles this process from start to finish on your behalf.

To claim your §179D deduction, the IRS requires your energy-efficient building must be certified as installed as part of a plan designed to reduce the total annual energy and power costs by 50% or more.

Yes, according to The Energy Policy Act of 2005, LED lighting qualifies for the §179D tax deduction. The tax deduction varies linearly from $0.30 per square foot at 25% lighting power density reduction (LPD) to $0.60 per square foot at 40% lighting power density reduction (LPD). The LPD reduction is determined by comparing with ASHRAE 90.1 standards. For warehouses, this requirement increases to a 50% LPD reduction.

Lighting systems must include automatic controls prescribed in the ASHRAE 90.1 standard and a provision for bi-level switching in all spaces except hotel and motel guest rooms, storerooms, restrooms, and public lobbies. The illuminance levels must meet the minimum requirements as per the IESNA lighting handbook.